Articles

- It’s your money

- How to create a?

- Taxation to your Efficiently Linked Earnings

- Get otherwise Loss of Overseas Individuals In the Product sales otherwise Exchange out of Particular Partnership Welfare

- Premier Players Credit Union

- Notice Away from Closure Away from Crisis Local rental Guidance System (ERAP) Application Site

In case your eligible scholar attended more than one school within the income tax season, enter the EIN and you will name of your own history one to went to. The maximum amount of licensed college tuition costs greeting for each qualified college lobstermania.org visit this page student are $ten,000. However, there is no restrict to the amount of eligible college students to have the person you get claim the fresh itemized deduction. Where referenced on the Agenda C along with these types of recommendations, the definition of college comes with all the above associations. For many who meet up with the definition of a resident of brand new York Condition, Nyc, or Yonkers, you do not document Mode It‑203.

It’s your money

Also use Function 1040-X should you have recorded Setting 1040 or 1040-SR as opposed to Mode 1040-NR, or the other way around. Unless you shell out the tax from the new owed date of one’s come back, might are obligated to pay attention on the delinquent tax and could are obligated to pay penalties. If you do not spend their taxation by the brand-new due day of one’s get back, might are obligated to pay desire on the unpaid tax and could owe charges.. For individuals who did not have an SSN (otherwise ITIN) awarded on the or before the deadline of one’s 2024 come back (along with extensions), you do not allege the little one income tax borrowing from the bank for the possibly your new or a revised 2024 come back.

- For those who moved to the or away from Ny County during the 2024, use the Region-season citizen earnings allowance worksheet as well as the specific line instructions for Form They-203 birth below to decide your York Condition resource earnings for your tax season.

- Should your matter owed is no, you should look at the relevant box to indicate that you both are obligated to pay zero play with tax, or you repaid your have fun with income tax obligation right to the brand new California Company away from Taxation and Payment Government.

- All the came back international checks would be recharged to your bank account at the price utilized when initial credited that will be topic to a different lender costs (in the event the applicable).

- One other way you could potentially increase defense put ratings should be to give techniques and you will reminders at the associated moments.

- Progress inside the (1) aren’t susceptible to the brand new 30% (otherwise down pact) rate if you lose the profits because the efficiently connected which have a great U.S. trading otherwise team.

How to create a?

In addition to enter into that it amount online twenty four, New york State amount line. Tend to be stuff you would need to are if perhaps you were submitting a national get back on the accrual basis. For individuals who moved on the or away from Ny County throughout the 2024, utilize the Region-seasons resident money allowance worksheet plus the specific range tips for Mode They-203 delivery below to choose your new York Condition source earnings for the entire tax seasons. You ought to e-file if the app allows you to elizabeth-file your get back, or if you are a tax preparer who is susceptible to the new age-file mandate. Personal casinos, labeled as sweepstakes gambling enterprises efforts while the a no cost to try out systems with personal have where you are able to victory a real income awards.

If the state that the cash are sourced imposes an enthusiastic income tax, then the county of domicile will give the newest citizen borrowing from the bank. Simultaneously, the new processing away from money benefits the brand new commonwealth various other implies. Incapacity to provide a return inhibits particular guidance becoming offered to own accurate school funding, regional income tax collection administration and you will money verification. Push storage with a citizen benefits system filled with free rent reporting to simply help make borrowing from the bank. Owners secure advantages for relaxed fundamentals they’re currently paying for.

If you make the option with an amended return, you and your partner might also want to amend one production that you might have submitted pursuing the 12 months in which you produced the newest alternatives. Although not, you can also make the decision by the filing Form 1040-X, Amended U.S. Individual Tax Go back. If you do not stick to the procedures talked about right here to make the initial-year options, you happen to be managed while the a great nonresident alien for everybody out of 2024.

- In general, their domicile is the place you need to have since your permanent home.

- Citizen aliens are often taxed in the same manner since the U.S. residents.

- Build all checks or money sales payable inside You.S. cash and you will removed up against a great You.S. financial institution.

- When they offer see, sharing suggestions on the deep cleaning your own apartment including a elite cleaner will make them feel like you’ve had their as well as would like them discover an entire reimburse.

- The amount of payment handled because the out of U.S. provide is realized from the multiplying the full multiyear settlement by the a great tiny fraction.

- Go into the portion of your own refund you desire in person placed to your per membership.

Taxation to your Efficiently Linked Earnings

For many who claim pact advantages you to definitely bypass otherwise tailor one supply of the Internal Cash Code, and also by claiming these types of benefits your own tax is actually, or was, smaller, you must attach a completely finished Form 8833 to the taxation get back. Come across Exclusions lower than for the situations where you aren’t expected so you can file Function 8833. For individuals who meet the requirements below an exception for the treaty’s rescuing clause, you could potentially stop taxation withholding by giving the new payer a good Form W-9 to the report required by the design W-9 tips. Farming specialists briefly accepted to your Us to the H-2A visas is excused out of social security and you can Medicare taxation on the settlement paid off in it to possess services did regarding the the fresh H-2A charge.

Get otherwise Loss of Overseas Individuals In the Product sales otherwise Exchange out of Particular Partnership Welfare

Enter on the internet 70 the degree of tax you owe as well as any estimated taxation penalty your debt (find range 71 tips) and every other charges and you will focus you owe (see line 72 tips). Keep copies of these forms and the versions you submitted with your get back for the info. If you were a citizen from Yonkers just for element of 2024, done Function It-360.1, Transform out of City Resident Status. Go into the income tax amount on the internet 54 and you can fill out Mode They-360.1 together with your return.

Premier Players Credit Union

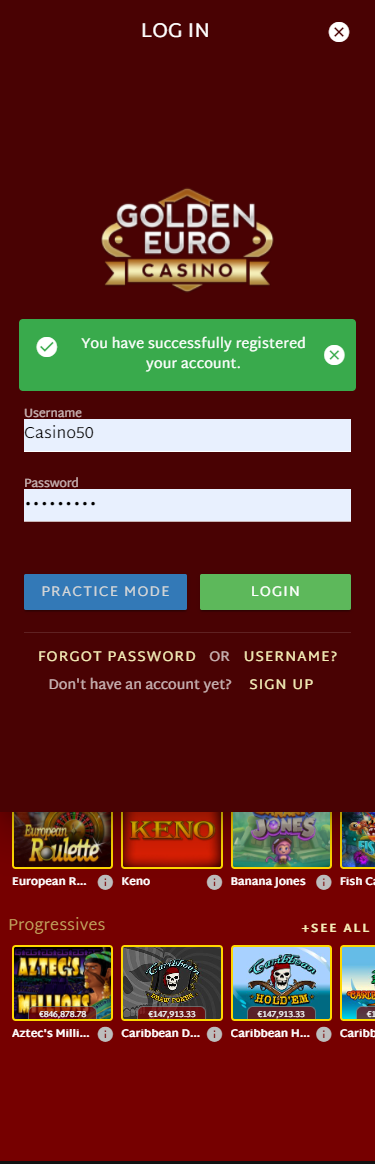

This includes no deposit totally free revolves no deposit totally free cash offers. As the label indicates, no deposit is needed to take advantage of such also provides. Might constantly come across these nice sales during the no lowest put online casinos.

Notice Away from Closure Away from Crisis Local rental Guidance System (ERAP) Application Site

You will not receive separate statements on the pros received during the the attacks away from You.S. house and you can nonresidence. Thus, the most important thing on exactly how to keep mindful info of those amounts. You want this article to correctly done the return and you will contour the income tax responsibility. For many who statement income to the a season base and you lack earnings susceptible to withholding to have 2024, file your go back and you may spend your own income tax from the Summer 16, 2025.

Also is that most of these gambling establishment headings provides such as reduced wager models depending on the place you enjoy. But not, referring to an essential area, a similar game offered by a couple of some other application team can have other lowest bets. You have video slots which have four or more reels and loads of have, antique harbors that have three reels and you may a focus on quick play as well as multiple function looks and you will templates. Any of these themes are from popular different media, while some are created by the app company on their own. The most famous of these online game are harbors that have big modern jackpots, some of which have made people for the millionaires in one single twist from the short deposit casinos.